More news

- Nigeria’s paint industry navigates regulatory changes and economic challenges amid p...

- Focus on the global coatings market: Global coatings market outlook

- View from the UK: Navigating chemical policy and sustainability

- Architectural coatings in Nepal and Bhutan

- Focus on adhesives: Unveiling unbreakable bonds – Testing redefines physical strengt...

Bharathan Ramakrishnan, Orr & Boss Consulting Inc, reports for PPCJ on the fastest growing major paint market in the world: India and its environs

The India paints and coatings market has experienced substantial growth due to several driving factors, such as rapid urbanisation, infrastructure development, increasing disposable income and a booming construction industry. Additionally, the expansion of the automotive sector and the rising demand for industrial coatings have significantly contributed to the market’s growth. These factors have resulted in India being the fastest growing major paint market in the world; we expect this fast growth to continue.

Trends and challenges

- The market is witnessing a growing trend toward environmentally friendly and sustainable coatings. This has led to increased research and development in water-based, low-VOC (volatile organic compound), and eco-friendly formulations.

- The market is primarily driven by factors such as rapid urbanisation, infrastructure development, increasing disposable income and a booming construction industry. Additionally, the automotive sector’s expansion and the demand for industrial coatings also contribute to market growth.

- The industry faces challenges such as volatile raw material prices, stringent environmental regulations and intense competition.

India paints and coatings market overview

India is the largest market in South Asia, accounting for more than 80% of the region’s paint and coatings sector. Despite the COVID-19 pandemic’s challenges, the Indian paint market rebounded swiftly and continued its fast growth.

- Market size and growth: India’s paints and coatings market is estimated at US$11.2bn in 2023, and is expected to reach US$16bn by 2028, growing at a volume CAGR of 6.75% and value CAGR of 8.25%.

- Key drivers: The market is driven by a booming construction industry, a recovering automotive industry and increasing consumer spending. However, fluctuations in raw material prices and stringent environmental regulations pose challenges.

- Emerging opportunities: There’s an increasing demand for newer technologies like multifunctional paints and nanotechnology, as well as a rise in eco-friendly paints.

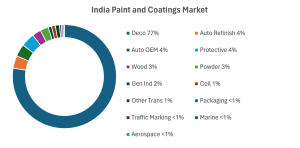

The pie chart below shows the breakdown of the India Paint & Coatings market by segment:

Decorative coatings

The decorative segment has been the mainstay of the Indian paint & coatings industry and is 77% of the market. A healthy construction pipeline in the county, ambitious schemes by the Indian government such as Housing for All, Smart Cities and rising urbanisation have been the main demand drivers of decorative paints in the country. These factors are expected to play a major role in the future growth of the decorative paint consumption in the county in the medium and long term.

Urbanisation in particular will play the most important role in the growth of the decorative paint segment. Currently 35 % of India’s population resides in urban area. The pace of urbanisation has increased significantly over the last two decades. This pace is likely to continue, and it is estimated that 600 million people will start living in India’s cities by 2030, going up to 820 million by 2050. By 2035, the percentage of population in India residing in urban area will be 45% according to a UN report. To cater to this growing urban population, India has to build 600 to 800 million square metres of urban space every year till 2030.

The Indian government is actively boosting housing construction, aiming to provide homes to about 1.3 billion people. The country is likely to witness around US$1.3trn of investment in housing over seven years and the construction of 60 million new homes. As a result of this investment, home sales are growing at a rapid rate, especially in the major cities.

READ MORE:

Industrial segment

Despite recent advances in the country’s industrial development, the demand for non-decorative industrial paint is only 23% of the total paint and coatings market in India. Globally and across the rest of Asia, non-decorative industrial coatings are approximately 50% of the market. The industrial coatings segment in the country has not been able to match the growth figures of decorative paint segment in the country.

Auto OEM and automotive refinish are two of the largest sub-segments in the non-decorative industrial coatings market in India. These two segments comprise one third of the industrial coatings market in India.

The expectation is that going forward, the auto OEM, auto refinish, Protective and General Industrial Segments will drive the industrial coatings market further. The number of cars assembled in India has grown at a 6.6% CAGR since 2019 and the expectation is that it will continue to grow at a high rate going forward. Not only has automotive production grown at a high rate but the number of registered vehicles has been increasing at a rate of 10% per year, leading to growth in the refinish market.

The India protective coatings market is estimated to be valued at US$400M in 2023. The market is poised for robust growth over the next five years with a projected volume Compound Annual Growth Rate (CAGR) of 5%. The key drivers of this growth are urbanisation, infrastructure development and industrialisation. The protective coatings market in India has traditionally relied on solvent-based coatings like epoxy, polyurethane, acrylics and alkyds. However, there is a noticeable shift towards more sustainable technologies, including low-Volatile Organic Compound (VOC) coatings and water-based, eco-friendly alternatives. This trend aligns with global efforts to reduce environmental impact and promote sustainability.

Intensifying competition

The Indian Paint Market, initially dominated by a few key players, now sees many new entrants backed by large conglomerates, intensifying competition. Grasim Group, Astral, JK Cement, JSW Paints and Pidilite Industries are among the new entrants, leading to increased competition and potentially impacting the market share of established players.

READ MORE:

Bangladesh paint and coatings market overview

Bangladesh represents another significant market in South Asia with a steady growth rate between 6% and 8%. The paint and coatings industry in Bangladesh is estimated to be US$715M and 350Mlit.

- Market Structure: The sector has around 50 companies operating, with Berger Paints Bangladesh leading the market, holding 48% of the market share. Other significant players include Asian Paints, Roxy and Pailac.

- Key Drivers: Rapid urbanisation in Bangladesh has provided numerous opportunities for paint and coating producers. The country’s large population and ongoing infrastructure development contribute to the market’s steady growth.

Conclusion

The Indian paint market exhibits promising growth prospects driven by urbanisation, infrastructural developments and technological advancements. Despite challenges, the market is poised for expansion, with opportunities emerging in eco-friendly solutions and innovative coatings. However, intense competition and regulatory pressures necessitate strategic adaptation for sustained growth and market leadership.