More news

- Asian paint regulatory round up – Indonesian exterior paint still uses lead, warns W...

- Nigeria’s paint industry navigates regulatory changes and economic challenges amid p...

- Focus on the global coatings market: Global coatings market outlook

- Ask Joe Powder – October 2024

- Chinese paint majors look to domestic consumer sales as commercial real estate slumps

The U.S. construction and housing markets have been on a rollercoaster over the past few years. Following an era of historically low interest rates, frenzied bidding wars, and soaring home prices, the market has experienced a significant shift. Mortgage rates, which skyrocketed to over 8% in 2023, are now hovering below 7%, dramatically cooling down homebuyer demand but keeping inventory scarce and prices high.

These factors, combined with evolving trends in nonresidential construction, present a unique landscape for the coatings and adhesives industries, which play a critical role in both residential and commercial construction projects. The figures presented throughout this article, sourced from ChemQuest TraQr®, illustrate the complex dynamics driving these markets and provide a deeper understanding of where the opportunities and challenges lie for the coatings and adhesives sectors.

Rebounding Residential Construction, with Challenges

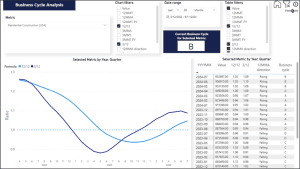

The residential construction market, particularly single-family housing starts, has been slowly recovering from the turbulence of the past year. As shown in Figure 1, the 12/12 ratio* for residential construction has improved to 1.05 by mid-2024, signaling a recovery from its earlier slump. The 3/12 ratio, while showing some short-term volatility, highlights a positive long-term trend.

Figure 1: Business Cycle Analysis—Residential Construction (USA)

Source: ChemQuest TraQr®

This rebound is critical for coatings manufacturers, as new homes require both protective and decorative coatings. The demand for exterior coatings, in particular, is expected to rise as single-family home construction picks up. Coatings that offer weather resistance and durability, such as those for roofing and siding, will be in high demand. Meanwhile, adhesives play an essential role in the construction of modern homes, from securing roofing materials to bonding concrete and wood structures.

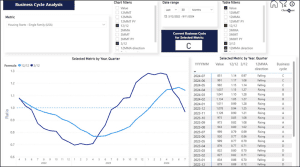

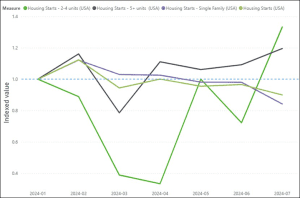

Figure 2 adds further context to the residential recovery, showing a steady increase in single-family starts throughout 2024, although the 3/12 ratio indicates some recent slowing.

Figure 2: Business Cycle Analysis—U.S. Single-Family Housing Starts

Source: ChemQuest TraQr®

This growth in single-family homes aligns with a broader trend in the housing market, where buyers are still eager to find new homes despite high prices and interest rates. According to data from the National Association of Realtors (NAR), the median sale price of existing homes in June 2024 reached $426,900, the highest on record. Similarly, new construction homes saw a median price of $417,300. However, the persistent lack of inventory, with only a 4.1-month supply of homes, continues to drive prices upward, making coatings for home renovation and upgrades another growth area for manufacturers.

Diverging Trends Across Sectors in Nonresidential Construction

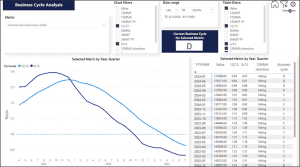

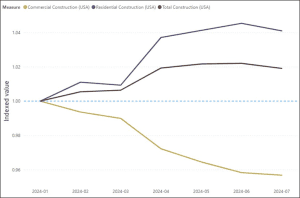

The U.S. nonresidential construction market is also experiencing varied growth across different sectors. Figure 3 shows us that the commercial segment has struggled, with the 12/12 ratio falling to 0.93 by mid-2024; this indicates a continued downturn in traditional office and retail construction. However, niche sectors such as manufacturing facilities and warehouses are driving growth, offsetting declines in other areas.

Figure 3: Business Cycle Analysis—Commercial Construction (USA)

Source: ChemQuest TraQr®

Spending on manufacturing construction is projected to increase by nearly 14% in 2024, fueled by demand for new facilities and warehouses. This sector now accounts for more than a quarter of all nonresidential construction spending, up significantly from its share just a few years ago. Coatings and adhesives manufacturers will find opportunities in this sector, particularly for specialized coatings that provide protection in harsh industrial environments and adhesives that bond metal, glass, and other materials used in large-scale manufacturing plants.

Moreover, data center construction—a subcategory of the broader office sector—is another area of growth. Spending on data centers has rapidly increased, now accounting for over 3% of the overall nonresidential market. With the rise of e-commerce and cloud computing, data center construction is likely to remain strong, driving demand for fire-resistant coatings and high-performance adhesives used in the construction of these facilities.

Institutional Construction Represents a Key Growth Area

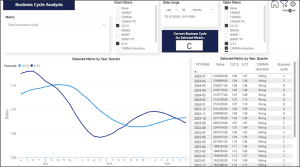

Institutional construction is another bright spot in the nonresidential sector, particularly in education and healthcare. Total construction activity has been steadily rising (see Figure 4), and this trend has been driven by institutional projects.

Figure 4: Business Cycle Analysis—Total Construction (USA)

Source: ChemQuest TraQr®

The American Institute of Architects (AIA) Consensus Construction Forecast predicts that institutional construction spending will increase by more than 10% in 2024, followed by a 4% gain in 2025. Education, which accounts for nearly one-fifth of all nonresidential construction spending, is a key driver of this growth. Many schools and universities are undertaking new construction and renovation projects to accommodate growing student populations, while healthcare facilities continue to expand in response to the aging U.S. population.

For coatings manufacturers, institutional construction presents opportunities for products that meet strict environmental and safety regulations, such as low-VOC (volatile organic compound) paints and antimicrobial coatings. Adhesives used in the construction of healthcare facilities, which must meet rigorous health and safety standards, will also see increased demand.

Sector Conditions and Market Challenges

While the overall nonresidential building market is seeing healthy growth, Figure 5 illustrates the divergence between different sectors. Manufacturing and warehouse construction are booming, while traditional commercial sectors like office spaces are stagnating. The rise in warehouse construction is particularly notable, with its share of nonresidential spending increasing from just over 6% in 2019 to more than 9% today.

Figure 5: Global Economic Indicators—Construction

Source: ChemQuest TraQr®

The construction market faces ongoing challenges. Rising financing costs, driven by increasing yields on 10-year treasury bills, have made it more expensive to finance new construction projects. The Federal Reserve’s survey of loan officers indicates that banks are tightening lending standards for commercial real estate loans, further constraining growth in certain sectors.

Moreover, declining commercial property values (offices have seen a 26% drop since mid-2022) are making it less feasible to invest in new office buildings. This has led to reduced demand for coatings and adhesives used in traditional commercial construction. However, the growth in manufacturing, data centers, and warehouses offers a counterbalance, creating opportunities for manufacturers that can adapt to these shifting trends.

Future Stabilization and Growth Opportunities

Looking ahead, industry experts forecast that construction spending will continue to grow, albeit at a slower pace. The AIA Consensus Construction Forecast predicts that nonresidential spending will increase by over 7% in 2024 but will slow to just 2% growth in 2025. Meanwhile, residential construction is expected to stabilize as mortgage rates hover around 5.5-6%, providing some relief to homebuyers.

As shown in Figure 6, multi-family housing starts have been particularly volatile but are expected to stabilize as more affordable housing options are developed. This will drive demand for coatings and adhesives in both new construction and renovation projects.

Figure 6: Global Economic Indicators—Housing Starts by Units

Source: ChemQuest TraQr®

For coatings and adhesives manufacturers, the key to success in this evolving market will be flexibility and innovation. Companies must continue to develop products that meet the changing demands of both residential and nonresidential sectors, from high-performance coatings for manufacturing facilities to environmentally friendly paints for homes and schools.

Agility will Bolster Success

The U.S. construction and housing markets are undergoing significant changes, with residential construction recovering, commercial sectors diverging, and institutional projects driving growth. For the coatings and adhesives industries, this presents both challenges and opportunities. By focusing on sectors like manufacturing, data centers, and institutional construction—while staying agile in the face of market shifts—companies can capitalize on the ongoing growth in 2024 and beyond.

To learn more, reach out to the author at mrezai@chemquest.com or visit https://chemquest.com.

*For Further Reading: “Understanding Business Cycle Analysis,” The ChemQuest Group, Inc., August 2024,

By Michael Rezai, Senior Consultant, The ChemQuest Group, Inc.