More news

- Asian paint regulatory round up – Indonesian exterior paint still uses lead, warns W...

- Nigeria’s paint industry navigates regulatory changes and economic challenges amid p...

- View from the UK: Navigating chemical policy and sustainability

- Ask Joe Powder – October 2024

- Chinese paint majors look to domestic consumer sales as commercial real estate slumps

Douglas Bohn from Orr & Boss Consulting Incorporated, provides an overview of the global coatings market.

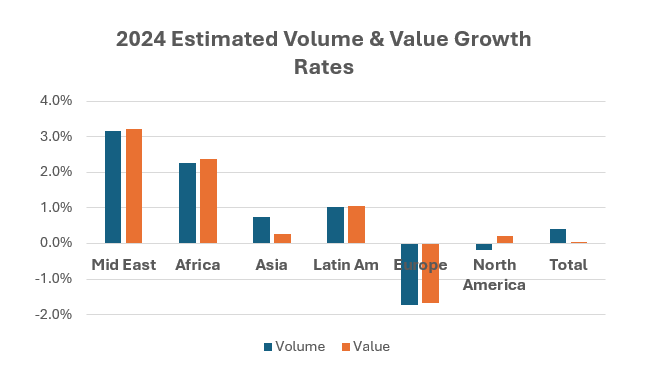

This year, the global paint and coatings market remained stable, with no significant growth globally but no significant decline either. Higher interest rates and reduced paint purchases across many regions led to lower than anticipated growth at the start of the year. However, as interest rates begin to decline, we are seeing initial positive movement in the paint and coatings markets and expect to see stronger growth in 2025 compared to 2024.

Global Paint & Coatings Market Overview

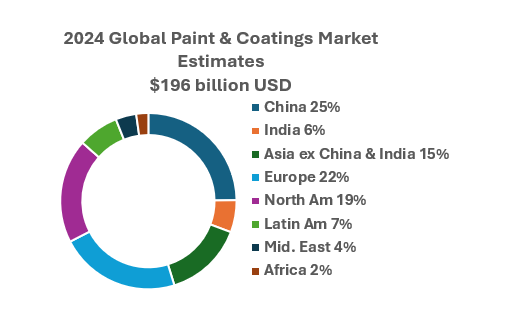

Overall, we estimate the global paint and coatings market to be valued at $196 billion US Dollars. China represents the largest share at 25%, while India and the rest of Asia together account for 21% of the market.

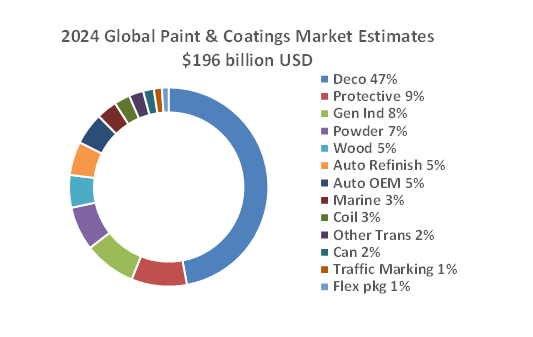

By segment, decorative coatings represent the largest share, accounting for 47% of the market value. This segment is the largest across all geographic regions.

Global volume growth is estimated to be less than 1% and value growth is close to 0%.

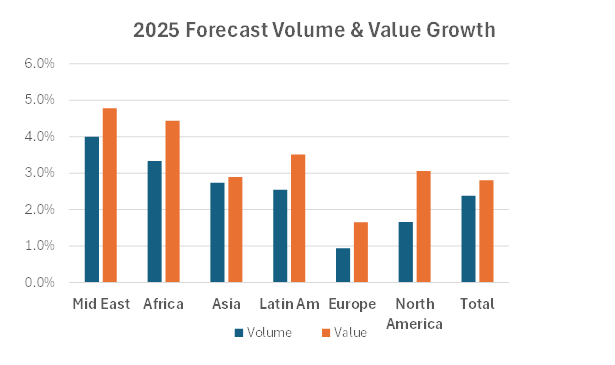

In 2025, we expect the markets to grow faster as interest rate reductions begin to take hold and the post-Covid inflationary pressure subsides. Overall, we expect growth in the 2-3% range.

A summary of our expectations for each major region is provided below.

China:

China is the largest single paint and coatings market in the world, accounting for 25% of the global market, with an estimated value of $49 billion USD. A key issue impacting China’s economy is that its post-Covid growth rate is lower than expected. The real estate and property markets continue to struggle, leading to declines in the decorative coatings sector, as well as impacts on the wood and coil markets. In most other sectors, growth is flat, with the exception of the automotive OEM market, where sales and production are showing positive growth. Additionally, the protective and marine coatings markets are experiencing growth in China.

Recently, China’s government has announced several stimulus measures, but it is still too early to assess their impact. At this point, we expect the decorative paint market in China to remain flat next year, while the non-decorative industrial markets are likely to experience modest growth of 1-2%.

India:

We estimate the paint and coatings market in India to be valued at $11 billion USD. This year, we expect growth of 5% in volume terms and 4% in value terms. India’s economy is the fastest growing among the major global economies, which has contributed to the country’s paint and coatings market being one of the fastest growing in the world. While growth remains strong, it is not as robust as previously forecasted. The cumulative effect of inflation over the past several years has led to a downgrading of paint purchases in India. Contractors and consumers who once bought premium paints are now opting for mid-tier paints, those who used to buy mid-tier paints are switching to economy options and some consumers who previously purchased economy paints have dropped out of the market entirely.

Despite this, the market in India continues to grow and is expected to maintain high growth rates. Per capita paint and coatings consumption in India remains very low compared to other regions, at 4.5 liters per person per year, compared to the global average of 5.9 liters per person per year. This indicates that there is still significant potential for growth in India’s paint and coatings market.