More news

- Nigeria’s paint industry navigates regulatory changes and economic challenges amid p...

- Focus on the global coatings market: Global coatings market outlook

- View from the UK: Navigating chemical policy and sustainability

- Architectural coatings in Nepal and Bhutan

- Focus on adhesives: Unveiling unbreakable bonds – Testing redefines physical strengt...

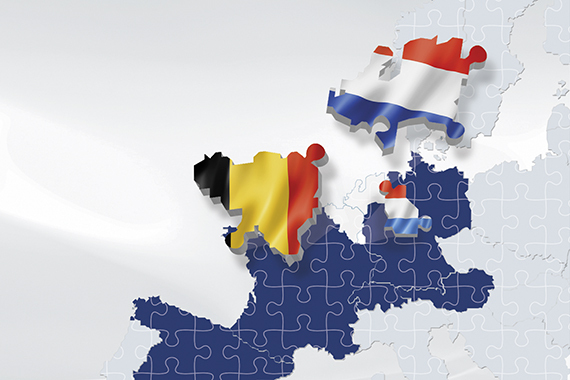

Liz Newmark reports for PPCJ from Brussels on the strengths and weaknesses of the paint and coatings markets of Belgium, the Netherlands and Luxembourg (Benelux)

Although the low countries boom in the paints and coatings markets of Belgium, the Netherlands and Luxembourg (Benelux) during the Covid-19 pandemic is easing, as well as the industry being hit by Russia’s invasion of Ukraine and the cost-of-living crisis, the sector is holding up well.

Revenue generated in the paint, wallpaper and supplies market is projected to deliver revenues of a substantial US$1.1bn in 2024, according to Germany-based global data and business intelligence platform Statista [1]. Furthermore, the market is expected to experience a compound annual growth rate (CAGR) of 3.04% between 2024-2028, said Statista.

Considering the respective populations of the three countries this year (11.7M in Belgium, 18.2M in the Netherlands and 673,000 in Luxembourg, according to world statistics service Worldometer [2], revenue per person from this market is estimated at US$36.98 in 2024.

Belgium

Belgium is expected to generate US$319.6M revenue in the paint, wallpaper and supplies market in 2024, with an annual CAGR of 2.67% from 2024 to 2028, said Statista. And according to industry research specialists IBISWorld [3], Belgium’s broader annual paint, coatings and printing ink manufacturing industry sector’s revenue is worth an estimated €1.8bn in 2024. Out of this sector’s 86 businesses, the Netherlands-based AkzoNobel has the biggest market share, followed by US-based PPG Industries Inc and Germany’s BASF, said IBISWorld.

According to France-based market intelligence experts ReportLinker [4], Belgium is projected to remain the fifth largest paint exporter worldwide by 2026, with exports forecasted to reach 3.9M kg.

On becoming President of Belgium’s paint, varnishes and inks federation IVP Coatings in March 2022, Lieven Seys said the industry’s main challenges are: “Limiting the impact of high raw materials and energy prices, meeting the ambitious targets of the [EU’s] European Green Deal [such as becoming climate neutral by 2050], and encouraging more people – young and old – to take up a career in paint.” [5]

“The challenges are enormous,” added Ann Wurman, IVP Coatings Managing Director since October 2023, noting the high raw material and energy prices and the need to transition towards a circular economy.

A paint manager at one of Brussels’ leading Belgian DIY chains, Brico, told PPCJ that paint prices had however fallen slightly in Belgium this year: “People come here to buy all sorts of paint, with Levis a very popular brand,” he said – Levis is owned by AkzoNobel.

“Another big seller is Renaulac, a brand that uses recycled materials and whose packaging is made from recycled plastic. Customers are keen to buy paint that is environmentally friendly,” said the Brico Manager. For example, Renaulac Echo is made from “bio-sourced alkyd resin derived from by-products of the wood or food industry,” said a company note.

READ MORE:

The Netherlands

In the Netherlands, paint, wallpaper and supplies revenue should reach US$760M in 2024, Statista reported [6]. This market is anticipated to experience an annual growth rate of 3.44% (CAGR 2024-2028).

Meanwhile, the Dutch wider annual paint, coatings and printing ink manufacturing sector’s revenue was worth €3.9bn this year. It grew at 1.3% CAGR between 2019-2024 and is expected to grow further, said IBISWorld [7].

Just as in Belgium, a major trend in the market is the demand for eco-friendly and sustainable paint and coatings, driven not only by increasing environmental consciousness among consumers but also strict European Union (EU) and national legislation.

“This year saw new plans from the government, postponements of those plans and yet always more regulations with associated costs. The fact that the regulatory burden is increasing year after year does not make doing business any easier,” said Paul Dokter, President of the Netherlands Association of Paint and Printing Ink Manufacturers (VVVF –Vereniging van Verf- en Drukinktfabrikanten), in its annual report 2023 [8].

“Not that we are against laws and regulations, but companies are very busy registering, administering and uploading everything, sometimes too busy,” he said, adding: “VVVF is on top of things and advocates more customisation and room in laws and regulations.”

The VVVF – whose 75 member companies represent 95% of the industry, which includes global giant AkzoNobel – and associated Dutch paint wholesalers’ organisation VVVH (De Vereniging van Verfgroothandelaren in Nederland) have launched (last November – 2023) a new online platform called SafeWithPaint for safety data sheets through the supply chain in 2023: from paint suppliers to paint wholesalers to painters, Mr Dokter continued [9].

The VVVF has also launched a project to help its companies meet the obligations of the Dutch government’s ARIE (Additional Risk Inventory and Evaluation) scheme. Revised in 2023, small-and-medium sized enterprises (SMEs) now need to comply with this legislation that aims to prevent and manage serious accidents with hazardous substances.

The Hague-based paint industry organisation is aiming to cut carbon emissions as much as possible. More than 75% of the Dutch paint sector’s CO2 footprint comes from raw materials, according to a VVVF study of SME manufacturing companies. Actions launched to help the sector further reduce its carbon footprint include its successful ‘Never flush paint down the drain’ initiative.

VVVF Managing Director Jaitske Feenstra told PPCJ that this successful campaign launched in 2023, where VVVF works with DIY stores to show consumers how to dispose of brush roller and paint remnants, would continue until summer 2025.

New developments in the Netherlands this year include the two new research laboratories that are being built by AkzoNobel at its Sassenheim site, its largest R&D site, the company announced on April 11, 2024 [10].

Work is starting on a technology centre for powder coatings. In addition, a new polymer lab has just opened which will develop innovative resin technologies for all the company’s businesses and “bring more sustainable products to the market,” said Roger Jakeman, AkzoNobel’s Chief Technology Officer.

VVVF also highlighted in August 2024 that Rotterdam’s famous Erasmus Bridge has now been repainted to its original pale blue. Another AkzoNobel-led project, this involved some 1,500 litres of Sikkens paint being applied to this suspension bridge [11].

READ MORE:

Luxembourg

The paint, coatings and ink market of less populous Luxembourg was valued at €64.2M in August 2024, with revenue stable from 2019 to 2024. The grand duchy’s four companies employ 143 people, said IBISWorld [12].

According to Statista, revenue in Luxembourg’s paint, wallpaper and supplies market reached US$16.83M in 2024, with annual growth rate recorded as 2.89% (CAGR 2024-2028). Luxembourg’s high-income population drives the demand for premium paint and wallpaper, making the country a lucrative market for luxury paint brands, added Statista [13].

ReportLinker noted Luxembourg is set to see a slight increase in paint imports over the next five years. In 2021, the country imported 252,530 kg, a figure predicted to reach 265,480 kg by 2026.

In addition, Luxembourg’s paint exports are set to decrease slightly over the next five years – from 4,420kg in 2021 to 4,080kg in 2026, said ReportLinker [14].